.png)

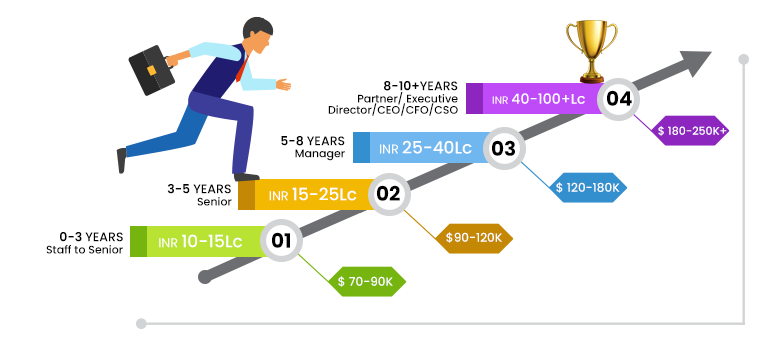

Master Your Path to Success with the US CPA Course

Enquire Now

Commerce & Management Graduate only

24X7 LMS Access

400+ Bite Size Videos

E-Books

360+ Hours Live Training

100% Placement Support